Investment in data platform for start-up intelligence supported by existing investors Knight Venture Capital and Shoe Investments

Dealroom, a global provider of data and intelligence on startups and tech ecosystems, has raised €6m in its Series A. The funding round was led by Beringea, the transatlantic venture capital firm, with participation from existing investors Knight Venture Capital and Shoe Investments.

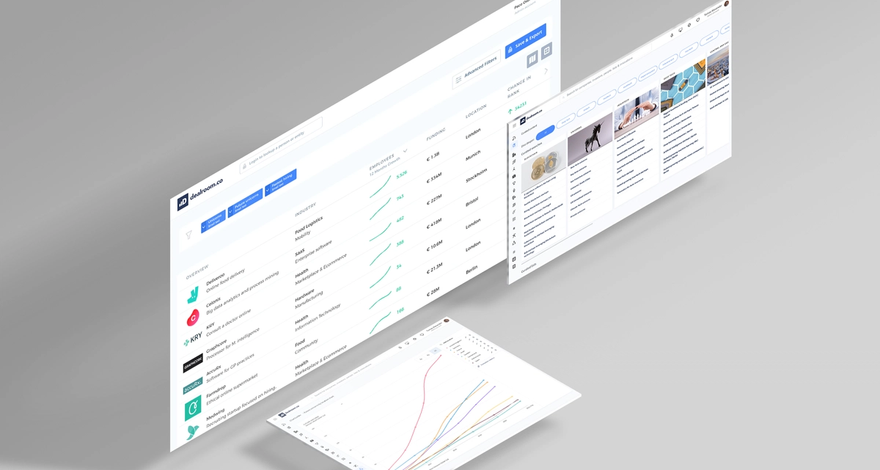

Founded in Amsterdam in 2013, Dealroom works with many of the world's most prominent investors, entrepreneurs, and government organisations to provide transparency, analysis, and insights on venture capital activity. By providing data transparency and an intelligence layer at the heart of tech ecosystems globally, Dealroom seeks to accelerate entrepreneurship and innovation for governments, corporates, VCs, and founders.

Today, the majority of top-tier investors actively investing in EMEA use Dealroom’s API, software and research, to identify the most promising startups from the moment they are conceived. However, Dealroom is not simply a data provider to venture capital investors; in fact, its greatest revenue source is its growing number of clients in the public sector.

Governments are increasingly recognising the power of startups as a job growth engine – in Silicon Valley 68% of all workers are employed by venture-backed companies, a Dealroom analysis shows. For the entire US that figure is 24%, while the rest of the world lies in the low single (or decimal) digits.

Since Dealroom completed its seed round two years ago, the number of public bodies connected to Dealroom’s API has quadrupled, now standing at 50, across five continents. These organisations use Dealroom’s tools to measure and grow their ecosystems via custom dashboards, and the market’s most extensive API.

In the past two years, the Dealroom team has tripled to about 75 people across more than 30 nationalities. The fresh capital will be used to accelerate global roll-out, invest in data, and double down on its mission to create the single source of truth for tech ecosystems in the entrepreneurial age.

Maria Wagner, Investment Director at Beringea, commented: “Our interest in Dealroom was first sparked by our love for the product. As the European tech ecosystem increases in size and complexity, investors, innovators, and policy makers need smart data and insights, which is what we found on Dealroom. Having connected with Yoram, we were able to get to know the business remotely during the pandemic and lead this fundraising round. We’re looking forward to working alongside this exceptional team to reach their goals.”